Invest in the Cambridge ecosystem

Posted on Mar 25, 2020 by Anna Lawlor

Anna Lawlor, co-founder of Luminescence Communications, on why the city’s booming economy is worth backing – and how to get your share

The fastest-growing city in the UK, home to some of the UK’s largest companies, and a world leading university renowned for launching innovative spin-off companies means Cambridge’s economy is booming. While many of us are immersed in the region’s economy as homeowners, business owners, employees or consumers, we might not have considered how we could benefit from this prosperity through our own personal investments.

This is the first in a series of article exploring how you can invest directly and indirectly in the Cambridge Phenomenon through different investment vehicles, from ISAs and pensions to crowd-funding and more. In this article, we look to the region’s largest companies, those listed on a public stock market – meaning anyone can become a shareholder and buy a slice of the profits.

The turnover of Cambridgeshire’ s largest companies leapt 10% last year to £10.7bn, according to a report

The turnover of Cambridgeshire’ s largest companies leapt 10% last year to £10.7bn, according to a report

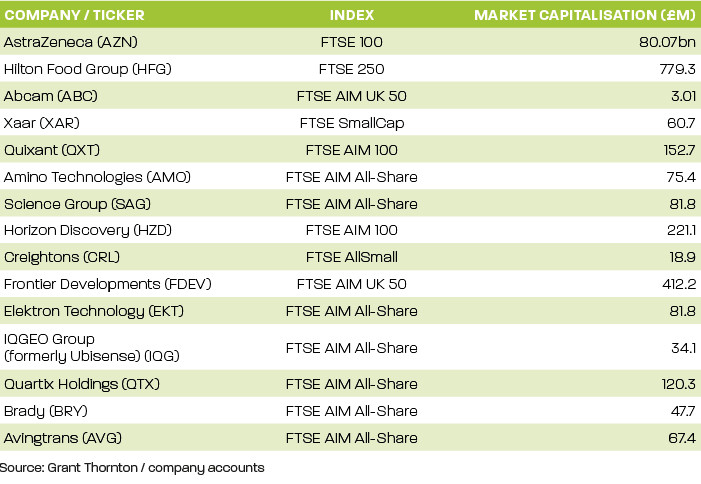

Cambridge’s listed companies

The turnover of Cambridgeshire’s 100 largest companies leapt 10% last year to £10.7bn, according to a report by Grant Thornton. The figure excludes AstraZeneca, whose global headquarters are in Cambridge, because of the firm’s large global footprint. Other multinationals are also excluded – such as Apple and Microsoft – that have offices in Cambridge.

Even larger than this strong 10% sales growth in 2018 was a mighty 17% rise in profits, hitting £780m. Out of the largest 100 companies in the region in 2018, 17 were listed on the UK stock market. This brings added skills, experience and kudos to the region, commentators believe.

Peter Hewkin, chief executive of the Centre for Business Innovation, a think tank that helps businesses collaborate on technology and business process projects, says: “I’m a big fan of large enterprises being based here, because it shows the region on the big boys’ landscape.”

“We also see useful and generous support coming from some of the bigger companies to help fund and resource activities, for example, to bring young people from a much wider region into STEM subjects and host events from which everyone can learn,” she says.

How to buy your share

To buy shares in listed companies, investors need to have either a stocks and shares ISA or a personal pension, such as a SIPP (Self Invested Personal Pension). Companies including Hargreaves Lansdown, AJ Bell, James Hay and Bestinvest offer such products for varying fees.

Once you have a financial product that can ‘hold’ shares (also known as listed equity), you can either transfer an existing pension into it or fund it with cash from another source. Once funds are in place, you will then be able to add your chosen shares into that financial product (ISA, SIPP etc). Shares can be searched for by company name (such as AstraZeneca) or stock market ticker (eg AZN).

To make financial gains on shares, investors can benefit from capital appreciation – the price of the shares rising above the price they were bought for – and dividends, if the company they are invested in pays out regular cash to shareholders. If, however, you do not want to receive dividend income straight away, most SIPP providers offer a dividend reinvestment service, which reinvests this income into more shares of the company paying them.

Irwin Mitchell’s UK Powerhouse report, which analyses the economic performance of 44 cities, showed Cambridge’s year-onyear growth in the final quarter of 2018 was 2.7%

Irwin Mitchell’s UK Powerhouse report, which analyses the economic performance of 44 cities, showed Cambridge’s year-onyear growth in the final quarter of 2018 was 2.7%

It is worth remembering that automatic enrolment is now compulsory, meaning all employees are paying into a workplace pension unless they opt out. Check what your workplace pension is invested in to ensure diversification across your investments.

There are different tax treatments and access rules for different financial products that hold shares, so it’s advisable to do your due diligence or get financial/tax advice before making an investment.

Investment considerations

The UK’s index of leading shares (largest companies), the FTSE 100, secures more than 70% of its revenues from overseas, showing the international nature of the UK stock market. This will also be reflected in Cambridgebased listed companies buying and selling nationally or internationally, and influenced by sectoral and other forces beyond the region’s boundaries, which could impact performance. Of the 17 Cambridgeshire-based listed companies in 2018, two were bought by private companies, meaning shares in the firms no longer trade on the stock market. These companies were drug development company Abzena and Produce Investments, one of Britain’s largest fresh produce companies.

Furthermore, part of Ubisense was acquired by Bahrainian private equity firm InvestCorp Bank and renamed IQGeo Group but remained listed.

Acquisitions can be an important component of a listed company’s returns. The £24.3bn purchase of Arm Holdings in 2016 by Japanese conglomerate SoftBank is a case in point. Arm’s share price rose by 41% on news, which is a financial windfall for its shareholders. Arm is now owned by SoftBank’s Vision Fund, which is not accessible to retail investors. UK investors could buy shares in SoftBank, which is listed in Japan, but that company’s performance is not intrinsically linked to the performance of Arm.

Future gazing

With so many cutting-edge private companies in Cambridge, the likelihood of more company flotations (listings) on the stock market is high. In Grant Thornton’s Cambridgeshire Ltd report, more than a fifth of the companies (22) are technology firms.

This includes five of the top ten fastest-growing companies out of the 100-strong field, led by DB Broadcast Holdings and Darktrace respectively. With the technology sector globally in rude health, there is a potential some of Cambridgeshire’s tech firms could be stock market darlings of the future. Companies looking to list on the stock market must go through a detailed IPO (initial public offering) process.

This includes announcing on the stock exchange an intention to ‘float’ and then attracting investors. Private investors will usually be able to invest in IPOs through their SIPP or ISA provider, or through a stockbroker.

For those looking to stay ahead of the pack, investment-related magazines or services such as Beauhurst may be able to help you predict the next companies due to list. Indeed, Beauhurst identified 30 companies it expected could float in the next few years based on various criteria, which included Cambridge Broadband Networks, one of the region’s largest 100 companies.

Growing dominance

Cambridge – its already vibrant economy buoyed by the Cambridge- Milton Keynes-Oxford Arc and the UK Innovation Corridor between London and Cambridge – is forecast to dominate as the UK’s fastest-growing city between 2016 and 2026 , according to the City Tracker report by Cebr and Irwin Mitchell.

Irwin Mitchell’s UK Powerhouse report, which analyses the economic performance of 44 cities, showed Cambridge’s year-on-year growth in the final quarter of 2018 was 2.7%.

Dame Kate Barker, one of the country’s foremost economists and chair of the Cambridgeshire and Peterborough Independent Economic Review, wrote in her 2018 report that the region’s 1.37% contribution to nationwide Gross Value Added “understates its importance” and that to double the area’s GVA by 2040 would be “realistic”.

This suggests it might be worth considering backing Cambridgeshire’s economy, rather than simply watching it roar away.

Anna Lawlor is co-founder of Luminescence Communications: weareluminescence.com